The strong reflection in GDP across most of the world may show to be more of a bounce than a movement. Procuring power, encouraged in many cases by government intervention was strong in 2021. Despite strong product request, supply chain issues have left factory shelves depleted and driven inflation sky high. In the US, the increase rate hit 4.6%, the highest of the developed markets, and is expected to remain relatively high at 4.0% in 2022. Eurozone increase hit 2.5% and is forecast to remain close to this level at 2.3% in 2022. This could reduce demand in 2022 and 2023 leading to slowing growth rates and rising insolvencies.

With new more contagious covid-19 variants driving infection rates to record highs the visual impact of the pandemic is readily evident with new lockdowns resulting in lower traffic levels, closed stores and hospitality businesses, less travel, still shorthanded offices and less crowded downtown areas. Despite this, demand for customer durables products in particular has been good. Getting these goods to market however has been an issue. The pandemic has activated a number of supply chain blocks that have delayed shipment of raw materials and finished products, depleted stock levels, and driven up freight costs. With these factors driving prices higher and skyrocketing fuel prices due to OPEC production caps and gas shortages, despite the surge in demand, slower GDP growth is expected in 2022 and 2023.

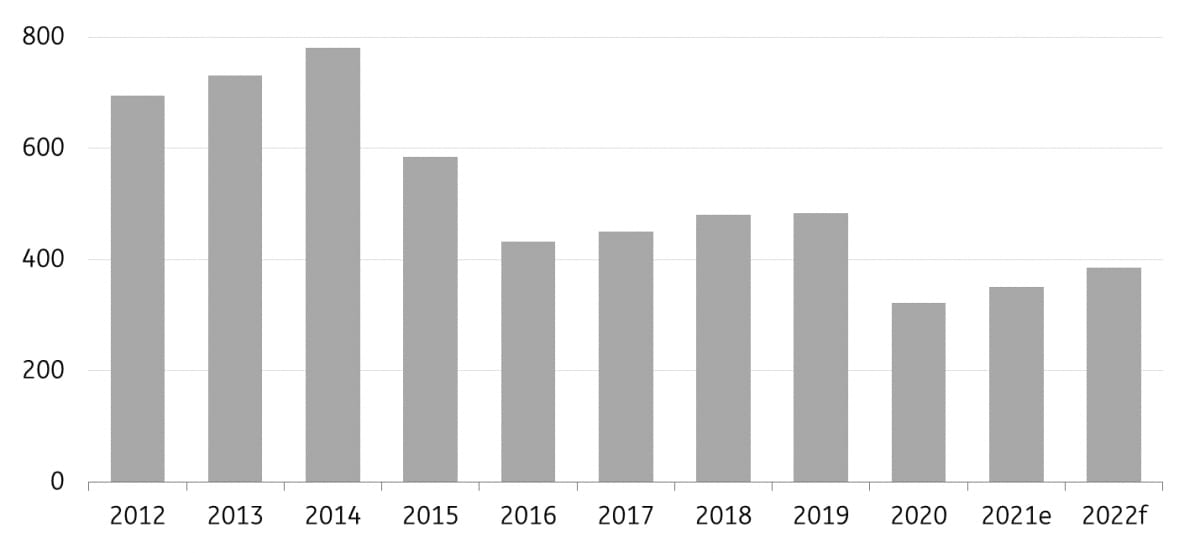

Recording high shipping costs

Although the point in inflation is eroding purchasing power, we expect global GDP growth to slow, but remain positive. Despite the rising inflation, consumer savings have collected and, to a modest extent, should offset inflation. Supply chain disruptions should decrease in the second half of 2022 and in 2023. This, along with financial policy mainly in advanced markets, should create some inflation relief.

John Lorié, Atradius Chief Economist commented; “Our current take on the situation is that current levels of inflation are temporary and will not persist. Inflation pressures will largely fade in the next two years as the current phase reflects an abnormal situation. Wage pressures are still relatively low and inflation expectations remain well anchored. We do see that high inflation is gradually forcing central banks to start monetary tightening, but more so in the US than in the eurozone.”